I wish to take issue with some of the statements in an article on the Microsoft Network news site. As usual, their content is from other websites. Anyway, this article is by a person named Andrew Lisa.

First, here’s part of the article.

In 2024, before he was elected for a second term as president, Donald Trump declared on Truth Social, “SENIORS SHOULD NOT PAY TAX ON SOCIAL SECURITY!”

That might sound like a blessing for retirees on fixed incomes — who happen to be one of the country’s biggest and most reliable voting blocs — but how much would seniors really benefit if Trump were to succeed in eliminating the tax on Social Security benefits?

It turns out that what appears to be a proposal to help the most vulnerable populations would actually benefit wealthy retirees the most — and the cost in lost revenue could threaten the program’s future and lead to reduced benefits for all.

Trump Wants To Eliminate Social Security Taxes: Here’s How Much the Average Retiree Would Save

The assertion that eliminating federal income tax on Social Security will bankrupt the system is nuts. Supposedly, the money paid out to Social Security recipients was withheld from their checks during their working years. If it accrued interest at market rates, it would be enough to last old folks for many years. The truth is that there is no segregated fund of money invested for Social Security. The claim that there is a coffee can buried on the White House grounds with an I.O.U. inside instead of money is basically true. Congress has been syphoning off the money for decades and spending it as it comes in. Taxing it is just a gimmick to gin-up class envy. Thanks Bill Clinton.

Let’s look further at the claim that wealthy retirees would benefit the most.

The article then claims that eliminating Social Security taxes will only benefit the rich making over $5,000,000 per year.

According to the Tax Policy Center, “The biggest winners would be those in the top 0.1% of income, who make nearly $5 million or more. They’d get an average tax cut of nearly $2,500 in 2025.”

However, elsewhere in the article it says,

“Right now, up to 85% of Social Security benefits can be subject to taxes, which feels like an extra burden when you’re already managing a fixed income,” she explained. “For instance, if you’re receiving $30,000 in Social Security benefits and are currently taxed on half of that at a 12% rate, you could potentially save $1,800 if these taxes are removed — a relief that could go a long way in your budget.”

So, in one spot this article says you need to make five million dollars to benefit $2,500 from this tax cut but two paragraphs prior it says someone making $30K could benefit $1,800.

Both statements can’t be true, but both are treated as equally valid and factual.

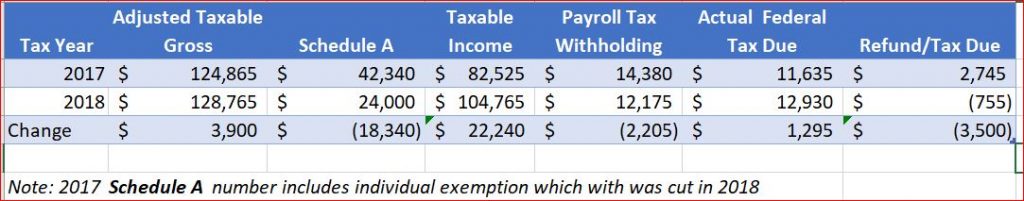

Folks, there is another issue related to retirement that this article doesn’t touch. My wife and I get a modest pension and last year I started on Social Security. We did our taxes last week for 2024. We walked out the door with the largest tax bill we have ever had in our lives and yes, last year we did have tax withholding equal to our tax bill for 2023.

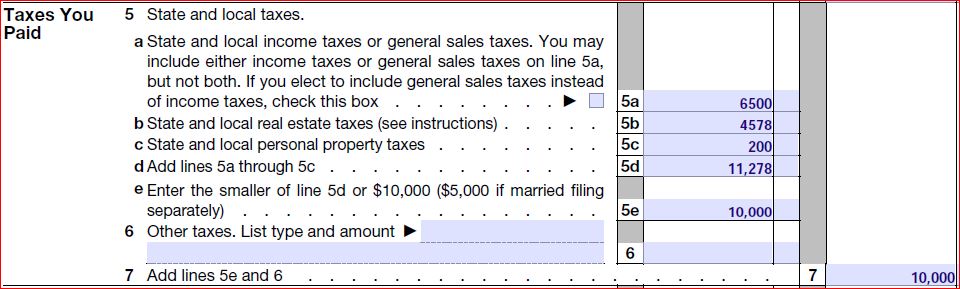

Our tax bill breaks down into three buckets.

- State tax was five times higher than last year.

- Social security was taxed.

- Obamacare tax. Yep, did you know that if you’re on Obamacare that you get to pay healthcare premiums every month and then get an additional tax bill for April 15th?

Obamacare

We are too young to be on Medicare which by law you must be on at age 65—even Warren Buffett and Bill Gates are on it too!

Since we retired from work in California and live in another state, we can’t get health insurance directly from our old employers. Thus, we must buy our own policy. Since we are retired, the best deal we can get is being stuck with Obamacare. Obamacare requires that you estimate your income for the coming year, and they then use that estimate to calculate a monthly premium. Well, we guessed wrong, so we got hit with what amounts to an Obamacare penalty. In our case $4,500. The penalty is added onto your tax bill with the federal government. Failure to pay by April 15th gets you penalties and interest from the IRS.

Most of this tax mess is the result of taking some money out of my wife’s IRA. The effective tax rate of this withdrawal was about 35 percent including the money withheld by the fund manager.

So, with less than three weeks until the tax deadline, we are struggling to pay a five-digit tax bill on a fixed income. Meanwhile, my wife is dealing with stage 4 cancer and its related medical expenses. She is not getting any better. Talk about piling on.

Bottom line: eliminating the Social Security tax will benefit many people. Obamacare punishes those on fixed income that are honest about their circumstances.

Lastly, please note that this article on Social Security mentioned nothing about the people that benefit from the bill Biden signed in January which allows teachers, firefighters, and others to get more money from Social Security. Biden’s increasing the benefit to others seemingly has no consequences to the long-term health of the program but Trump cutting a tax is going to bankrupt the system. WTF?