Just for those who are doubting my political allegiance I do support President Trump’s attempt but he is doing it all wrong. Sadly, this isn’t totally on him, it’s his generation and they are out of step with today’s Americans.

His “all or nothing” day of liberation approach backfired tremendously. It’s been said to me, “it’s not hard to herd a couple cats, but herding 10 is challenging, herding 300 is impossible”. Trump went after literally every country in his bizarre press conference. The best approach would have been to get our closest allies on board first, then work out from there. South Korea, Japan, and Mexico would have been my starting point. South Korea needs our military backing, ditto for Japan (tourism as well), Mexico is a little different but if they don’t want to negotiate add a 3% transaction fee to every US Citizen sending money via wire to Mexico and believe me, they would come to the table quickly.

I left Canada off that list as relations with them are low, he stupidly keeps saying he is going to annex Canada and is calling them the 51st state. Saying Wayne Gretsky should be their next governor is equally stupid. Canada, as a result, has been reaching out to other countries and offering to help make up the difference if the US stops trading with them.

I would have gone after Vietnam, Philippines, Malayasia, and other southeast Asian countries next. These countries have a low skilled workforce (for the most part), are typically poor, and like China, rely on slave labor to manufacture goods on the cheap. I wouldn’t threaten a tariff, I would say we want to invest American dollars in modernization of your production, warehouses, supply chain etc. with the goal being China seeing this and reacting. China does not want to lose its monopoly on most manufacturing of things, and their close proximity to China, and USA support causes a threat. Instead, Trump got into a d**k measuring contest and now China is lobbying those countries not to listen to us. Again, it’s the way he did it, not why he is doing it.

The European Union should have been the second easiest sell, it backfired as well. Some of this is due to his picking fights with NATO as most countries in the EU double as NATO countries. The EU has also turned to Canada and China to help fill the void. In this case I do heavily blame Trump, the EU is very similar to the US in that it has a very aging population not interested in working in factories, this should have been an easy deal to close.

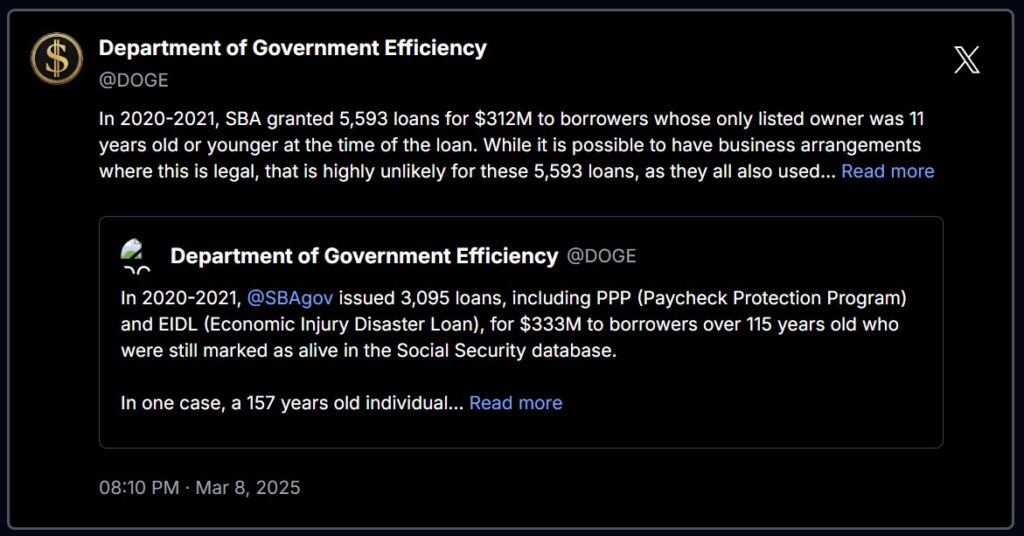

In closing Trump may think he is the greatest deal maker of all time, his problem is his bullying persona rubs people the wrong way. He showed his hand in his first term and now other countries are prepared for it. The bully does his best work picking on the smallest and most vulnerable and moving on from there, it creates fear and apprehension. When you try to pick on everyone at once, if someone(s) stands up to you, most of the rest will follow suit and then you are stuck. His tit for tat with Canada looks really foolish now, and while warranted, his comments regarding NATO and the Ukraine/Russia war are doing him no favors. He has been reduced to begging Xi Jinping to call him to get a deal done just to save face.

He got played because he never realized he didn’t have a card hand to bluff with. Other countries know America is a deeply divided nation we tend to go back and forth between which party controls the White House/Congress nothing is forever here. In the current climate of Executive Orders, if the other party takes the White House, the predecessor’s orders are erased before lunch is served on Inauguration Day! Most politicians only desire to be re-elected, not pass legislation, company executives only care about cutting expenses and stock prices, and no one in America wants to work in a factory! Also, our employment/wage laws are arcane compared to other countries. Look at CA alone, $20-hour minimum wage in fast food, mandatory overtime after 8 hours in a day, double time after 12, anything over 40 hours a week is overtime, mandatory breaks and lunchtime. Compared to slave wages and labor in other countries, the input price won’t get lower here. Also check out our environmental laws compared to most countries we are trying to barter with? It’s a lose/lose proposition.

I hope this works, but even if he negotiates a better deal, I just don’t think we will see the benefits.

Sadly, NAFTA and environmental/labor laws killed any chance of the jobs coming back.