Joe Biden doesn’t believe in tax cuts, but he is willing to mess with your refund and possibly prevent you from getting one.

My introduction to this brazen tampering with taxes was a form letter the I received from the IRS.

You may be eligible to receive advance payments of the Child Tax Credit (CTC) . If you’re eligible for advance CTC payments and want to receive these payments, you don’t need to take any action. You will receive a letter with more details.

The American Rescue Plan, signed into law in March, made important changes to the CTC for most taxpayers in 2021. The credit amounts increased for many taxpayers, and the credit is fully refundable, which means taxpayers can benefit from the credit even if they don’t owe any income taxes. The credit also includes qualifying children who turn age __ in 2021. The American Rescue Plan directs the IRS to make advance monthly payments of half the estimated annual CTC. The IRS will make payments from July through the end of this year.

For tax year 2021, the advance CTC payments will be half of the estimated CTC. The maximum annual CTC will be $3,000 per qualifying child between the ages of 6 and 17, and $3,600 per qualifying child under age 6, at the end of 2021. In general, qualifying children must live with the taxpayer in the United States for more than half the year.

The maximum credit is available to taxpayers with a modified Adjusted Gross Income of:

• $75,000 or less for single taxpayers,

• $112,500 or less for head of household,

• $150,000 or less for married couples filing a joint return and qualifying widow(er)s and• the maximum credit phases out for higher income taxpayers.

If you don’t wish to receive advance CTC payments, instructions on how to unenroll from these payments will be available by the end of June. Please continue to check www.irs.gov/childtaxcredit2021 for additional information about these advance CTC payments.

My first question after why, is what will this do to my taxes when I file on or before April 15th next year?

Folks, the question of whether you wish to participate in this is “dazzle the voters program” is in two parts. First what does the child tax credit do to my taxes? and second, how much will I get?

I took a look at my taxes from last year (2020 tax year). The Child Tax Credit in 2020 was $2,000.

The child tax credit is deducted directly from the amount of taxes that you owe.

Suppose per the tax tables, you owed $15,000 in Federal tax. The child tax credit is deducted directly from this amount. Thus $15K minus $2K is $13K. If you had $13K withheld from your pay, then you’d owe zero in additional taxes.

Biden is doing two things simultaneously with the credit this year. First, he raised the credit from $2K to $3K per child. (I’m omitting the amount for children under 6 in my example.) Then Uncle Joe is going to send you a series of checks between July and December which will total $1,500. The other $1,500 will then be available to deduct from your taxes.

Now I’m going back to my previous example to demonstrate the math.

Taxes per tax table $15K, minus Child Tax Credit of $1,500 is $13.5K. If you had $13K withheld from payroll, then you get to write a check to Uncle Joe for $500 next year. So much for free money. Thus, for every child between 7 and 18 years of age, you get to send in $500 per child to the government, come April 15th next year. So much for free money. Now granted, your mileage may vary but even if you usually get a refund at tax time, you will still get to pay by getting a smaller one or maybe having to pay.

If you are near the top of any of the earning amounts listed in the letter, then you probably better opt out. If you are in the bottom income brackets, then enjoy spending your refund this year instead of getting it next year like you usually do.

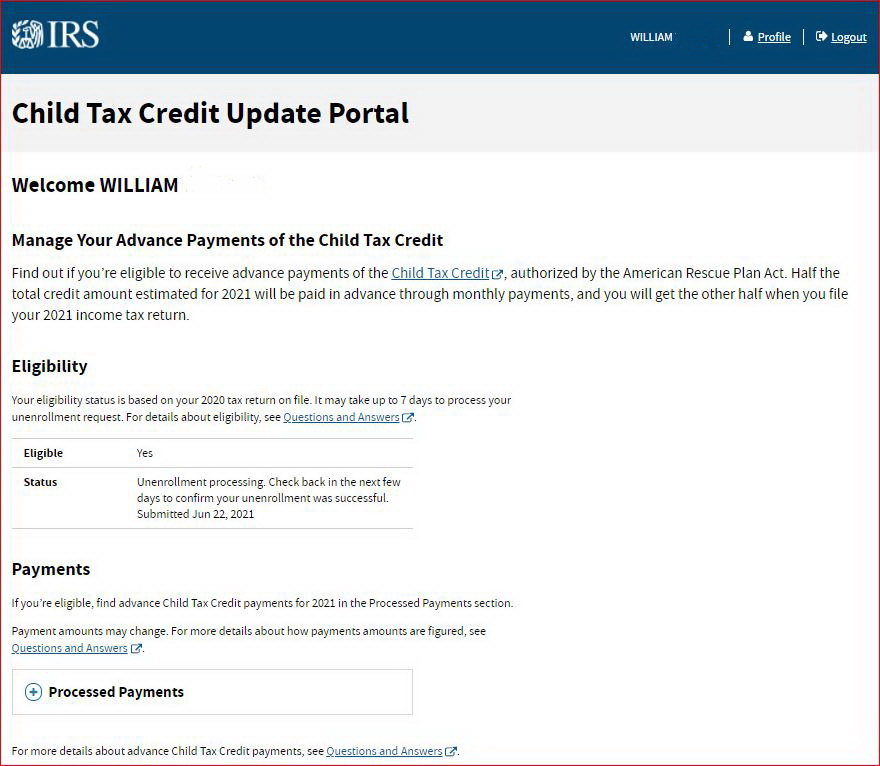

Frankly, I think this scheme will bite me in the fiscal butt, so I decided to opt out. Please note that doing so is difficult and time consuming. But I did it. Here is my guide.

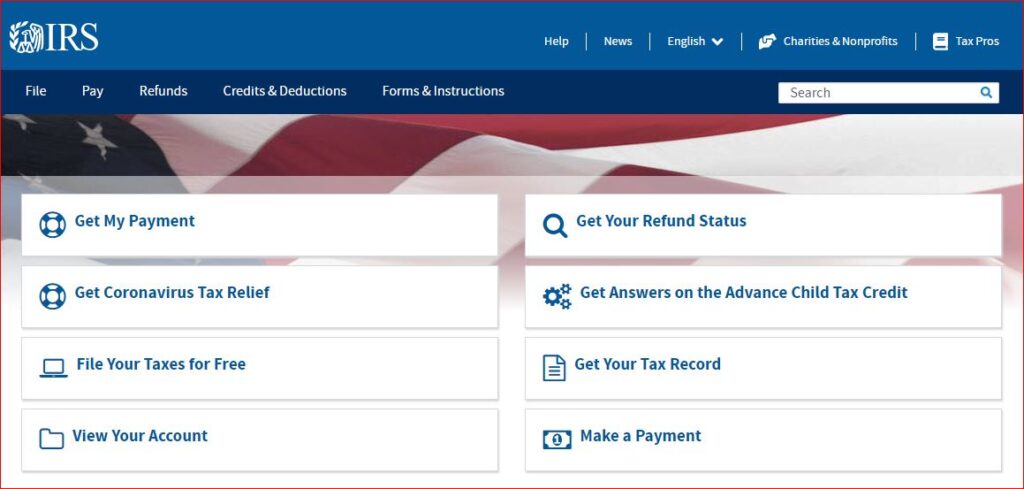

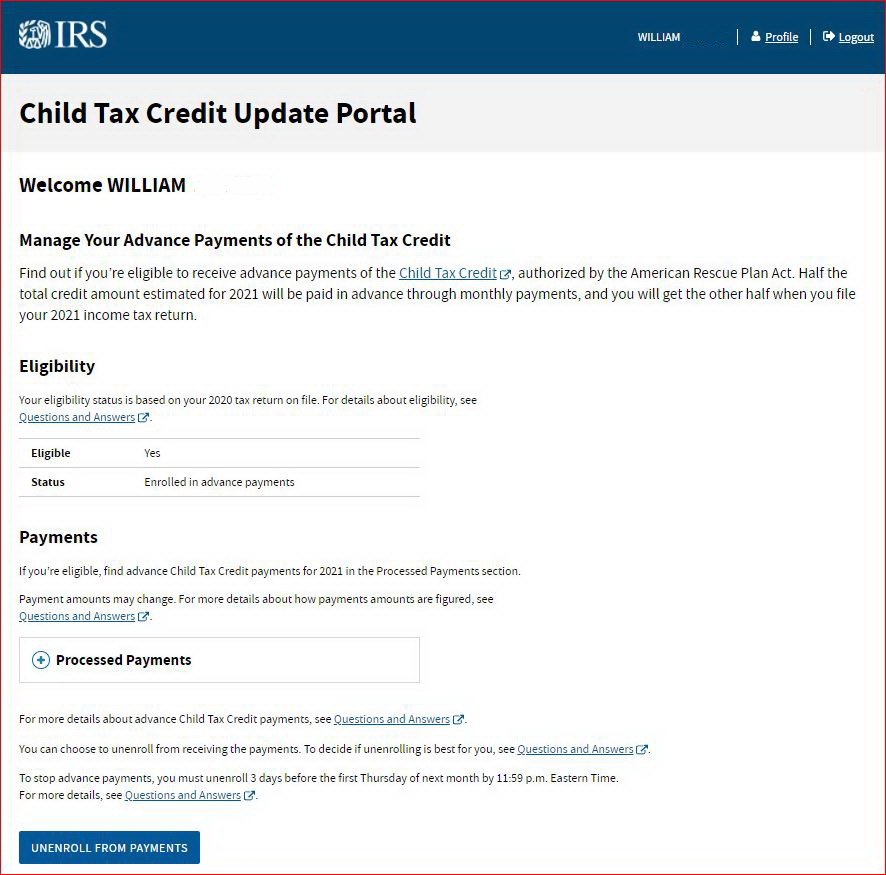

Your adventure in opting out begins at IRS.GOV.

On right side, click on Get Answers on the Advance Child Tax Credit

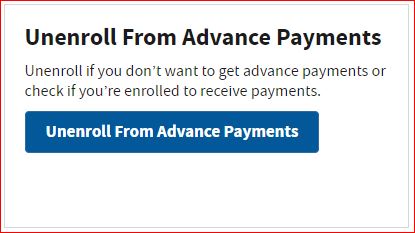

Select Unenroll From Advance Payments

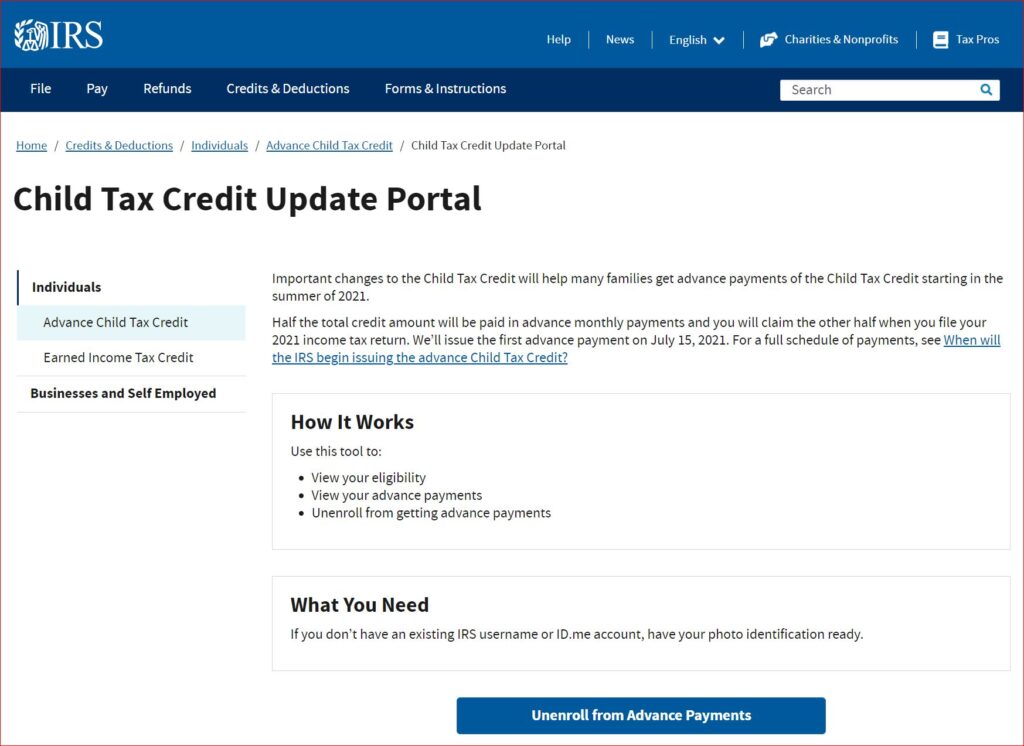

On next screen again click on Unenroll from Advance Payments

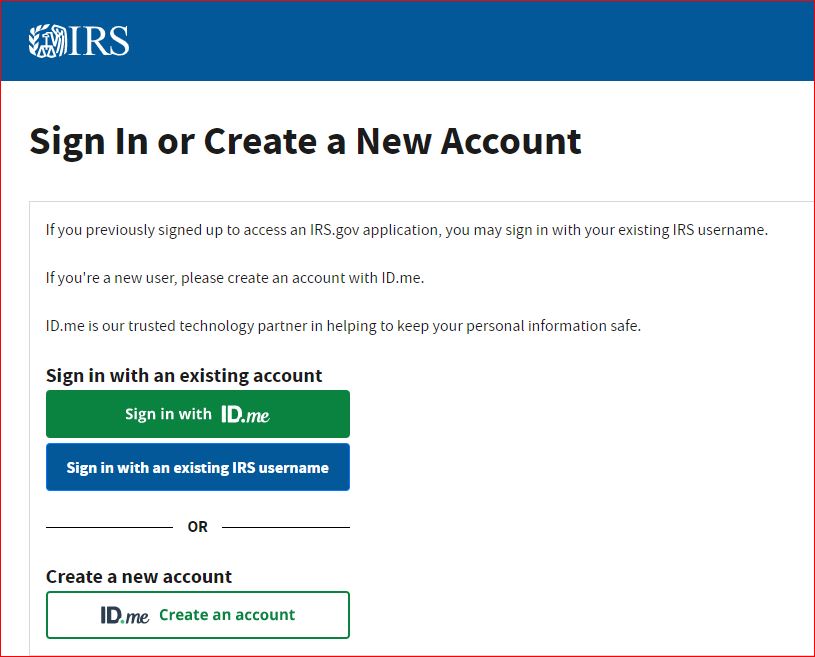

And just when you thought you were on your way, you hit a hard stop. You must verify your identity with ID.me. If you’re like me, you now get to create an account. Folks this process is cumbersome, frustrating, and time consuming.

You begin by entering your email and creating a password.

You then get to select a method of two factor authentication.

Then you need to switch to your phone and then take a photo of the front and back of your driver’s license.

You cannot do this step on a PC even if you already have the photos ready, the ID.me program is broken and won’t let you. Instead, ID.me asks for your cell phone number and then sends you a text message with an embedded URL in it. It reminds me of the U-Haul self-return process. You can only take live photos of your driver’s license.

After a few tries, you’ll get both sides of your driver’s license uploaded and then you get to take a live selfie with your front facing camera. It checks your face against the photo ID that you submitted. This step is especially buggy.

Plan on 20 minutes to do the ID.me process.

At this point, I was then able to return to my desktop PC and completed the process.

Click on UNENROLL FROM PAYMENTS

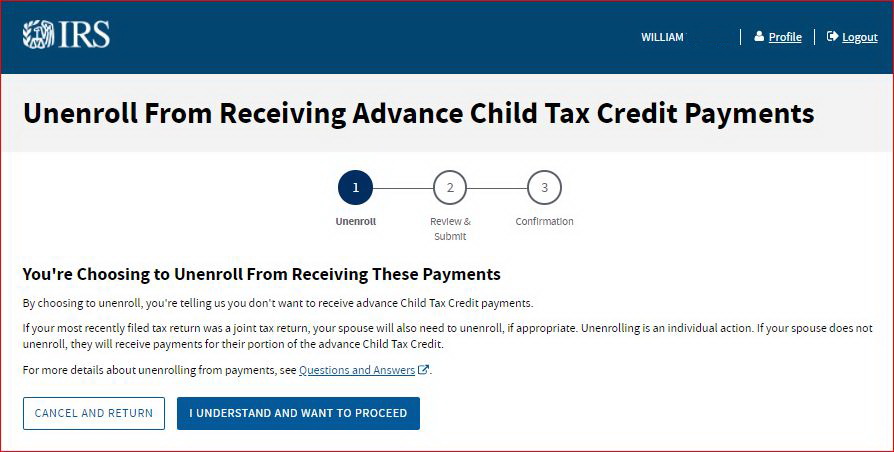

Click on I UNDERSTAND AND WANT TO PROCEED

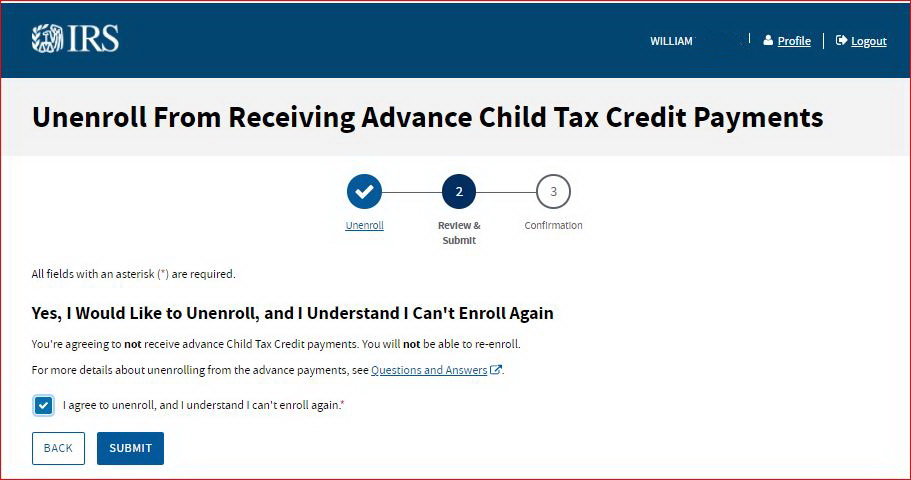

Make sure box is checked and click on SUBMIT

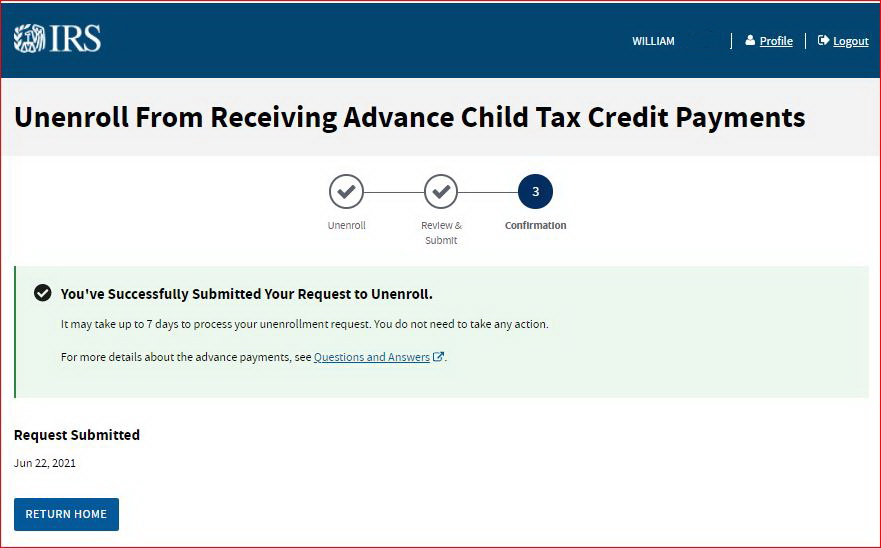

Then you get a confirmation screen Unenroll From Receiving Advance Child Tax Credit Payments

Except, if you’re married and file jointly, the opt out process is not complete. Your spouse now gets to do the whole process that you just completed. Yep, when I opted out, I only opted out of half of the automatic payment. In order to truly opt out, my wife now has to go to the IRS site and do everything that I just did.

Folks opting out is painful but for many, I think you will experience more pain on Aril 15th if you don’t.