The bad news is you won’t get a tax refund from the IRS this year. The worse news is you will be writing Uncle Sam a large check.

But why? Didn’t we get a tax cut this year?

I will get to that in a moment but first let’s talk about a financial planner’s view of tax withholding.

Zero Due—In Theory

If you always get a tax refund, you are not having the correct amount withheld from your paycheck each month. Really you are making an interest free loan to the government in order to get a large refund.

On the other hand, if you always write a check on April 15th then you are not setting aside enough throughout the year for your taxes.

A financial planner would advise you to try to owe zero each year; not too much either way. Like you, I tended to ignore this advice and enjoyed a large refund. Sadly, those days are gone.

Trump Tax Cut

Trump did two things that will rock your fiscal world.

First, he reduced the amount withheld for Federal Taxes each month. This resulted in you having more take-home pay in 2018. Tax rates were cut; in addition, however, some deductions were also limited or abolished. This leads to the second point.

Second, a cap was placed on the deductibility of local taxes. This cap is $10,000. If you live in states that voted for Hillary, then you are likely in trouble. If you live on either Coast: California, Oregon, Washington, New York, New Jersey, etc. then buckle-up. If you are employed and own a home, you will hit the $10K limit. Here’s how it works.

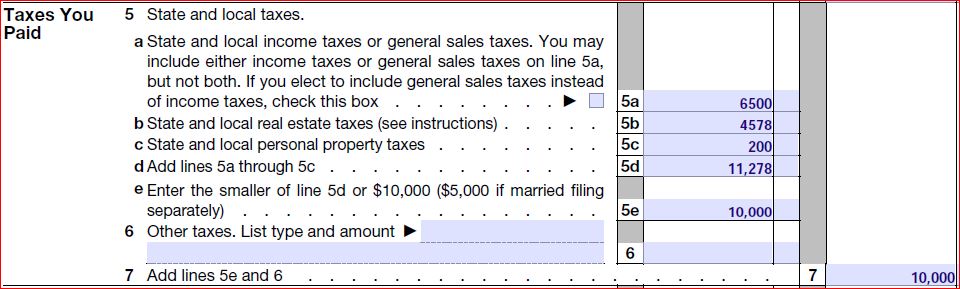

Above is a portion of 2018 Schedule A

| Line 5a | Supposed you had $6,500 withheld from your wages for California Payroll Tax and State Disability |

| Line 5b | You paid $4,578 in property taxes on your house in 2018 |

| Line 5c | Remember the portion of your DMV bill that is deductible? |

| Line 5d | Congratulations, you are above the $10K limit |

You now owe Federal Income Taxes on anything above the $10K limit. In the past all this was deductible. This was viewed as a subsidy to people living in high tax states. Why? Because the state could tax the snot out of you and the Feds allowed this taxation to be deductible. Thus, it awarded high local taxation.

The only other items on the Schedule A are Mortgage Interest and Charitable Giving. Unless these two are more than $14,000, you and the wife will get the standard deduction of $24K.

Also missing from the new Schedule A is Unreimbursed employee expenses—job travel, union dues, job education.

Also gone from the Form 1040 is the Individual Deduction.

If you are married, you can claim the Standard Deduction $24K plus a tax credit of $2K per child and that’s about it.

Impact

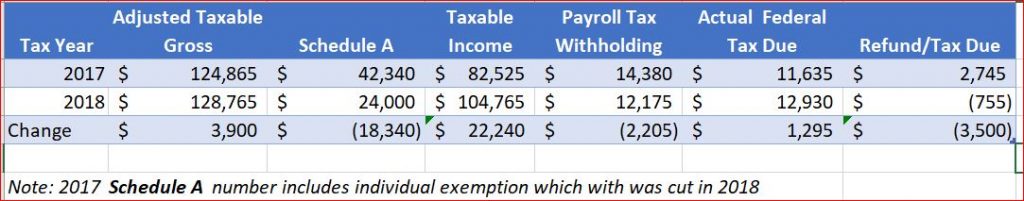

Last year between itemized and the individual deductions, a client was able to deduct $42K off their gross income. This year for the same client deductions total only $26K ( Standard Deduction plus one child). The one-year difference on the Schedule A is $18K. The net result of all tax changes is that their taxable income increase $22K over last year. Thus on April 15th, their refund is gone, and instead they get to write a large check to Uncle Sam.

In 2018, you did enjoy more take home pay with the new and lower tax withholding. Under the new tax tables, the couple in the example above got about $250 more in their paychecks each month; but clearly, they need to visit their HR department and have more withheld in 2019 if they don’t want to write another large check next year.