By Chief

We had an editorial board meeting here at Really Right last week when the news was dropping about Tesla rolling out their in-house auto insurance department. We agreed to let Aaron Park take the first crack at this one, since you know, he’s an insurance agent and all. Aaron didn’t act, so we feel we must report so the people can decide.

It was announce that Tesla has formed its own insurance company, drum roll please……….. Tesla Insurance. Oh, the millions I’m sure that were burned on that one. The consulting firm that came up with that name is one of pure genius. This new division offers insurance, but only to Tesla drivers in California, which is strange, this being, well… California. You see, California has the most diverse rating factors of all the states in the union outside of Michigan. This is very puzzling.

Tesla’s insurance license with the state of California lists the automaker as a property-broker agent and a casualty-broker agent. The documents show the license has been active since August 2017.

Tesla’s new insurance program prompted some early questions amid a bumpy rollout

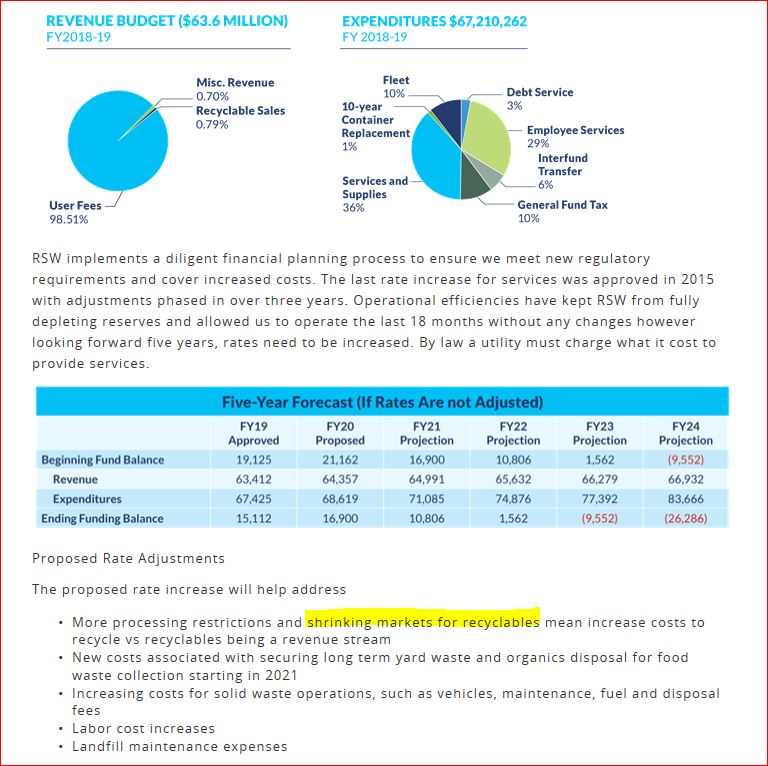

Like the auto industry, insurance is a low-margin business, as increased competition has made the costs of acquiring customers more expensive, Krzysztof Kujawa, the chief product officer at the insurance-shopping website Gabi, said. That means Tesla Insurance may not drive profits for a company that has posted losses in all but four quarters since going public in 2010.

Correct, Tesla is now: a dealer, a financer, and an insurance company all in one. Sounds like Elon is trying to mimic the Oracle of Omaha with this take on vertical marketing.

Berkshire Hathaway’s (NYSE: BRK-B) (NYSE: BRK-A) Warren Buffett argued in the company’s annual shareholder meeting earlier this year that Tesla’s decision to get into the insurance business could be a mistake. “It’s not an easy business,” he said. Buffett knows a thing or two about insurance. Not only is GEICO a Berkshire subsidiary, but Berkshire owns insurance companies that insure other insurance companies. “Our [insurance business] has been the engine propelling Berkshire’s growth since 1967,” Buffett wrote…

Tesla Is Getting Into the Insurance Business

However, this arrangement raises a set of questions that Elon will never be able to answer, and even better I spoke to the California Department of Insurance and they couldn’t answer either. First off, Tesla has a unique reputation of blaming the driver, not the car for anything that goes wrong. They use their vehicle’s telemetry logs and recordings to back this up; as far as insuring the vehicle goes, do the claim reps have access to this or does an independent third party? Well, it won’t be a third party…so scratch that. That is disturbing. Is this a backdoor way to limit product liability? But like the Ronco Knife sales guy on QVC says…but wait there is more!

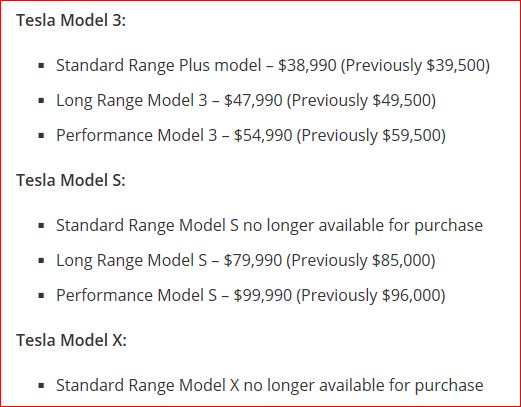

Tesla is making a bold claim that customers will save 20% over their current carrier but savings can be up to 30%!

“Starting today, we’re launching Tesla Insurance, a competitively priced insurance offering designed to provide Tesla owners with up to 20% lower rates, and in some cases as much as 30%,” the company said in a blog post.

Tesla says its insurance is now available in California

“Tesla Insurance offers comprehensive coverage and claims management to support our customers in California, and it will expand to additional U.S. states in the future.”

I am not sure this is a great promise to put out there, as with most commercials you see on TV from other insurance carriers, such statements are heavily disclaimed at the bottom of the ad. It is a very bold claim to say you can reap that kind of savings from a company who only insures Tesla’s over larger carriers with far more exposures to mitigate their risk. This creates bad will with your vehicle owners not to mention distrust. In addition, how can you be so sure your price is that much better…. most companies offer a bundled discount with home and additional vehicles. I hope they did their research on this one, yet something tells me they didn’t.

Tesla’s capitalization structure should be called into question as well. For example, at my company: Auto/home/life/health/bank/mutual fund businesses are all separate and must have separate capital to prove solvency. This capital must be held in separate reserve accounts, and in the case of Tesla, the California Department of Insurance (CDI) will look at their books every year to prove compliance. Just to point out that pretty much every pundit in the field has major questions about Tesla’s finances. Given that the company is burning through cash, issuing additional stock, taking out high risk loans, and their only real source of income is selling climate credits, I think you have to ask the obvious question….

How will Tesla pay out claims? Remember, Tesla may have extensive info on their own cars, but what about the car their driver hits? What about injury accidents? Will Tesla only allow the vehicles to be repaired in-house, even though this violates CA insurance laws? Will they even fix claimant cars, or will they be like AAA and just say fix it yourself and send us the bill? Too many questions here for me.

Tesla owners have dealt with high insurance costs due in part to the relative difficulty of finding replacement parts and qualified body shops. AAA raised insurance rates for Tesla vehicles in 2017, though Tesla argued that AAA’s decision was “severely flawed” because it compared Tesla’s Model S sedan and Model X SUV against dissimilar competitors.

Tesla says its insurance is now available in California

Tesla’s have long been a question mark for insurance companies, Business Insider Intelligence analysts say, due to their built-in sensors and Autopilot software. In 2017, AAA said that Tesla owners should pay more than traditional vehicles due to “abnormally high claim frequencies,” Automotive News reported in 2017.

I called the CDI about Tesla Insurance and they too were short on answers, like how they are capitalized, and their company structure (claims/underwriting/service/sales/special investigations etc.). Actually, more disappointing, a contact I have in this regulatory agency suggested Elon may have been able to put one by Ricardo Lara (the elected commissioner) because they are a “green friendly” company. Or maybe Lara owed Elon a favor after getting elected? Lara, like Aaron Park, has a policy of contributing to him first if you want an endorsement.

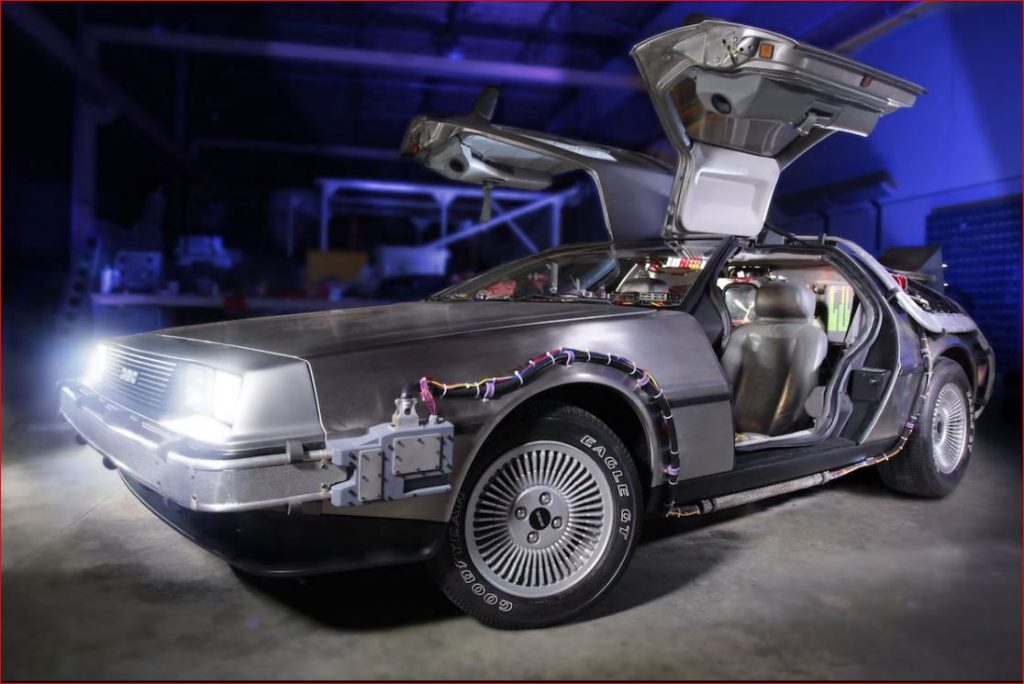

Final thought here, and likely the most disturbing, by the way. Look at the exposure Tesla has (there are not many) but look where their customers are all located (mostly coastal areas). What if a wildfire strikes that is similar to the magnitude of the one in Napa a few years ago? (Or the Oakland Hills fire many years ago) Such losses to a small company could be enough to wipe them out, and let’s not kid ourselves, Tesla’s are not cheap cars as referenced by their price.

Chief