Elon Musk is great at separating Liberals from their money. He flits around like a butterfly from one pipedream to another. Electric cars, solar power, batteries, space flights to Mars, and mag-lift travel at the speed of sound. Whatever crazy thing he can get other people to invest in. He will make prototypes or other devices to get others to invest, but please note, its other people’s money at risk not his. Musk takes a cut for himself off the top and then piles more investors into the bottom of the pyramid.

He bought Solar City, and it was financially unsustainable so what does he do? Why he folds the debt into his Tesla car scheme. Tesla isn’t panning out financially so what then? Oh, I know, why doesn’t he act like a crazy guy and get kicked off the board. Then when the bills come due and it collapses Musk won’t be on the board. Then he can blame the Musk-less board for not having the vision, passion, and dedication that he had to make it succeed. If only he had been there…

Look back to last summer. Remember Musk having a Twitter tantrum about the rescuer of the kids in the cave. He called the guy a pedophile or something like that. Then he smokes marijuana on that pod cast and then pulls the stunt of taking the Tesla private. Net result, Musk gets kicked off the board of his own company.

Is he nuts of crazy like a fox? He has access to information investors and other don’t plus he can read the handwriting on the wall. Get out before the stuff hits the fan that way he can save face and blame others. This allows him to go fleece his next group of Liberals with his reputation still intact.

Here’s more proof the Ponzi scheme is in trouble.

Tesla has lowered the price of its Model 3 by $1,100 amid reports that U.S. sales fell precipitously in January despite a $2,000 reduction that went into effect at the beginning of the month.

InsideEVs estimates that Tesla sold 6,500 Model 3s in the U.S. in January, which would represent a more than 70 percent drop from the prior month.

Tesla Model 3 price cut again, now starts at $42,900

Cutting prices and a 70 percent drop in sales in one month is bad enough but the other shoe is about to drop.

Tesla has a billion dollar debt coming due, and it could wipe out nearly a third of the company’s cash if the stock price doesn’t improve.

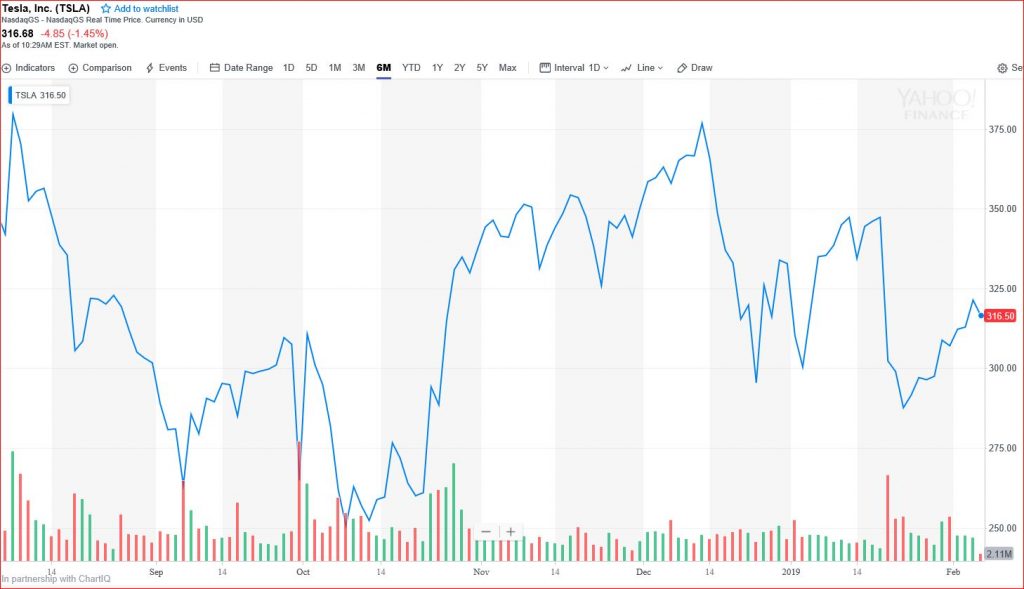

About $920 million in convertible senior notes expires on March 1 at a conversion price of $359.87 per share. But Tesla’s stock hasn’t traded above $359 for weeks. If the shares are about $359.87, then Tesla’s debt converts into Tesla shares. If not, Tesla will have to pay the debt in cash.

Tesla reported cash and cash equivalents of $3 billion at the end of its September quarter. The company continues to reveal pressure to maintain profitability, and announced Friday it would cut 7 percent of its full-time workforce.

Please note that the 3 billion cash and equivalents was in September. They are burning thru cash at a crazy rate and to pony-up one billion in cash in three weeks is a tall order.

Below is a chart of Tesla stock for the last six months. Do you really think that the stock price will be above $359.87 by March first when January sales are off 70 percent? No way Jose. Stock opened trading today at $316.50

Tesla is in deep trouble but never worry because Musk got in the lifeboat months ago to distance himself from the dumpster fire that’s coming.