I recently had a friend of mine who reads this blog ask if I “ever have any fun in my life, and what my future looks like?” This person referenced that the blog here hates debt, and apparently no one on the editorial staff will spend a dollar, on anything. This is complete and utter malarkey. What we are doing on this blog isn’t pointing out you should be eating a diet of ramen every day, we are pointing out that life should be lived within your means, but also with an eye toward the future. No one on this blog is a financial advisor who believes in telling clients not to take trips or have fun, while they live the good life. I’ll explain further below.

Sadly today we live in a world of illusion where style is far more important than substance. We as a society tell people to splurge on unneeded things constantly. We no longer view a pay check as revenues earned, we view it as a means to pay our monthly bills, and that is the wrong approach. We run everything through the credit card under the guise of a 1% cash back, or the 30 day terms. We see a red tag that proclaims “sale” and feel compelled to buy. The blog posts on this site have nothing to do with hoarding your money, buying gold, or locking yourself in your house and refusing to part with it. It is about planning for a very uncertain future, no one has a crystal ball, and things can change very rapidly as we have learned with the Coronavirus and its direct impact on the stock market, and global/domestic travel.

Case number 1: The former girlfriend who works 3 hours a day, takes 2 classes a semester at a local junior college. She is always broke well prior to the end of the month. After a little uncovering, the main culprit was marijuana. In a close second, credit card debt, and late car payment fees. All of this is a result of a general lack of drive and care towards her future, keep in mind she is 30. Her most important and immediate goal is getting stoned. Her intermediate goal is getting married and having kids, sounds like career advancement is on hold indefinitely.

Case number 2: The alcoholic guy we detailed some time ago. Never has any money, and is subletting a bedroom in the house he rents so he can make ends get close to meeting. While he never has money to buy food, or pay his debts, he has an endless supply of wine that would make a winery jealous. This person is on his 4th DUI in his 80 years on this earth and has recently been banned from drinking at church functions from 2 church groups. Most folks dream of their golden years traveling or relaxing, he lives his stumbling and stammering.

Case number 3: The guy who is 75k in credit card debt, in addition to his other bills as detailed here. He has champagne taste on a beer budget and wants a bailout. He is very desperate now and likely to lose both cars, and his house, and possibly his marriage. Keep in mind he has 2 young children to boot. His life is very similar to a bad car wreck, you know you shouldn’t look, yet you can’t take your eyes off of it.

Case number 4: A guy I have known since college, he got his now wife pregnant, and their kid is very special needs. He just recently wrapped up his degree, they got married, they have no income as she must stay home with child, and he is an intern…at age 33. Credit card debt? You guessed it, and they live in a bedroom at his parent’s house.

Case number 5: A person I’ve also known since college. Student loan and credit card debt, a 33% vehicle loan, every add-on imaginable, because well you only live once, and works a zillion hours a week at a theatre. I call her “red tag lady” because she needs to buy something everywhere she goes, and the only concept of a budget she has is when her card is declined, that means she needs to pay toward it. Case in point. We went out to dinner and keep in mind our coupon included enough food for 2, she decided to add on an appetizer and order take-out bacon fried rice on top of what amounts to a pretty large meal to begin with. A $45 coupon quickly turned into an $85 meal, with no alcohol included by the way. The most important thing in her life is finding a boyfriend right now, or as I call it a bailout.

Case number 6: A fellow church goer. Major health issues, all of them self-induced, fast food is a staple of the families diet, as in three times a day every day. He refuses to work, forcing his wife to labor almost all hours of the day. Credit cards? Check. High Interest loans? Check. A massive drug addiction? Check, he blames it on opioids. He is a hopeless case.

Now contrast that to myself.

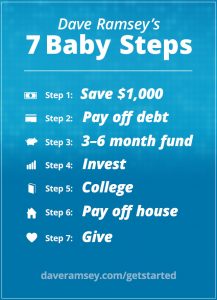

I worked very hard at my job, a boutique office with just 1 colleague. Drove a 14 year old car until it finally decided to cry uncle, saving me a pant load on car insurance and car payments. I learned to cook, and budget at a very early age, and had to bite the bullet and live at home for about 3 years after college while I found my career and learned a budget. While I may have hit the bottle a bit (a habit I’ve since kicked) I learned quite a bit during my time at home. I banked money, and invested in myself. I learned everything about the industry I worked in, almost obsessively. By year 3, I was going to take the test to start my own business with this industry, I passed, becoming the youngest ever. 2 years later I applied for and was accepted to take over someone’s office who was retiring, I was elated, maybe a bit scared but elated. My office partner (boss) took me out to lunch and said I can’t believe I’m going to lose you, but I’m going to make you an offer you can’t refuse. He made me partner and my cut is 49% of the business after tax income, he is still the owner, and a majority one at that. I agreed, and my life has changed big time since that date. I bought my house 5 years ago, and am making double payments to reduce my mortgage (I don’t call a mortgage debt) and while I had to buy a new car, I chose to lease and the terms are 0%. I have no debt and never had any. I may pay with credit cards but I pay in full each month. I started my Roth IRA at 25, and at present its value is about $75,000. I also have a stock “mad money” account valued around $75,000. This is in addition to about $15,000 in emergency savings which will only be tapped to pay bills. Keep in mind I’m 34. I have traveled to a bunch of different states and take several trips a year.

Conclusion: Contrast me to the 6 cases named above, it’s not an exercise in tooting one’s horn. It’s about knowing a need versus a want, and being meticulous and sticking to a budget. Make yourself indispensable and you will reap the rewards. Praying over decisions and not making rash one’s helps a ton as well. I work in an industry and in a field that is going the way of the dodo bird, hint it’s similar to a travel agent. I know this job will not be there for me… I’m preparing…just like you should be doing for the next recession/political risk. Trust me, banks play fast and loose with credit/financing during boom years, when things go bust they do not play nice. To tie this all together, the 6 cases named above? One claims to be a Republican, the other 5….they all support Bernie, hoping that you and I will be bailing them out. Lather. Rinse. Repeat.

Johnnie Does

PS. The new boat/car/jet ski’s etc. that you had to have fresh off the dealer’s lot; someone else will be buying those off you for a song if a recession hits as hard as I think it will. That someone is likely to be a guy like me who has saved up money during the good times. In the end, that boat/jet ski/car you just had to have but only took out a handful of times will be forfeited and given to another.