By Chief

William wrote a great article about the debt the other day and it got me thinking, which is quite dangerous by the way. The debt is absolutely insurmountable and as a millennial, it’s my future, so I asked quite a few friends of mine, for their thoughts. The answers will likely not surprise any reader of this site.

To put it bluntly, they do not care. Most of them work for the state/city/county and view their jobs and pensions are guaranteed. That should scare everyone, regardless of your thoughts on pension guarantees. The general approach by my generation to debt is one of apathy and compassion.

I’ll start with the latter first; it’s borne out of feelings and wanting to throw money at a problem in hope good will come from it. For example, healthcare for literally everyone and continued support of government run programs such as: food stamps, and other social justice programs into infinity. We want to give the homeless guy/girl/it a place to live, and 3 square meals a day along with spending money in hopes he will get a job…it doesn’t happen. However, we will keep trying because, we’ll just throw more money at it, and it eventually works itself out right?

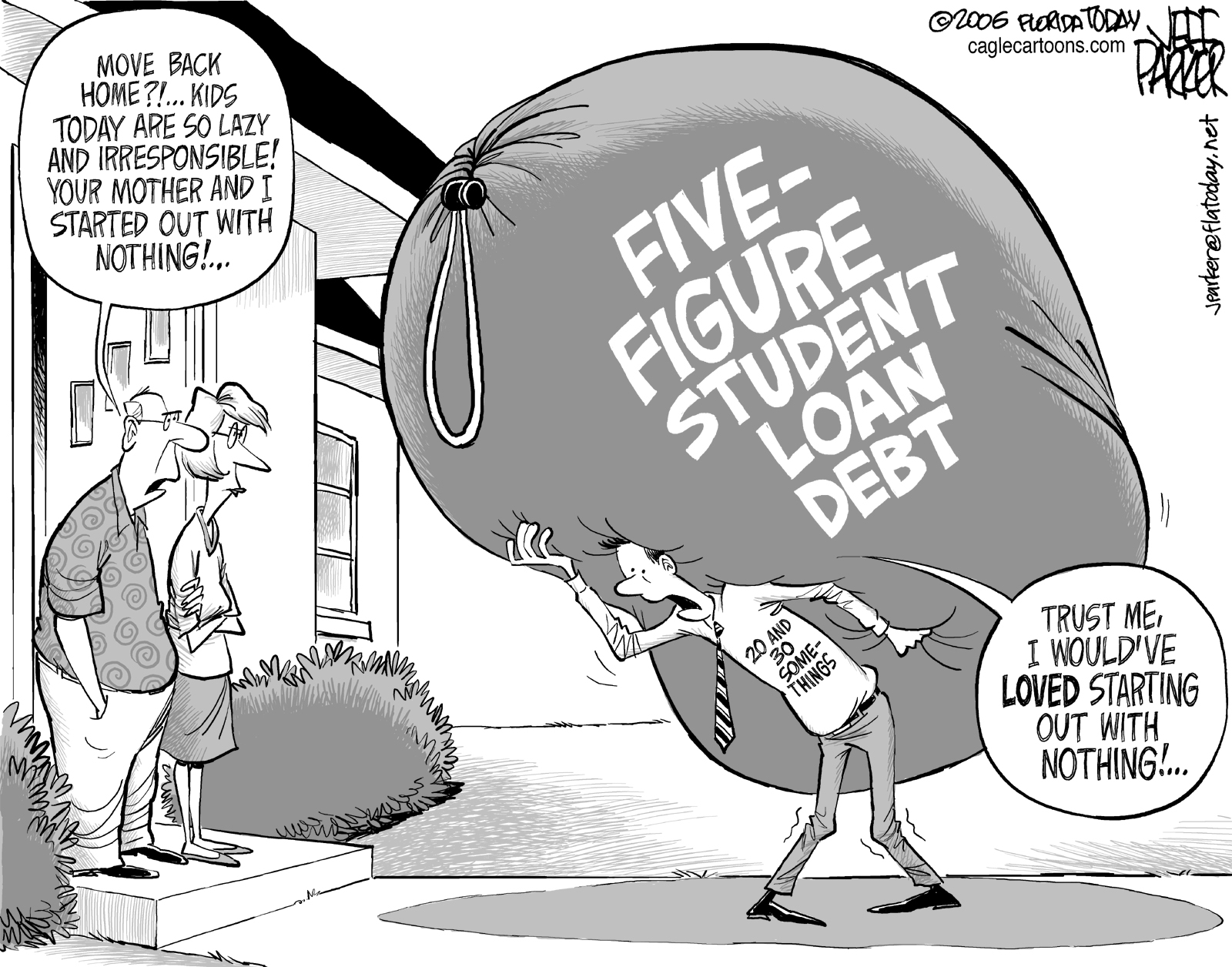

Now to the apathy part; debt is already a large part of our lives, mostly via student loans. We just view all debt as, well it’s there and as long as I make the payment, I’m good till next month. We see ourselves in massive debt and just assume we will eventually take care of it…. or we petition the government to get rid of it. Much like the 65,000 people who have applied for their loans to be forgiven only to be rightfully denied by the government. We know it’s there and it’s a part of our lives, but we don’t take it seriously.

However, the ones most at fault are the older generations (55-75). They are responsible not just for running up the tab on generations not yet born, but for installing in us a belief that debt is not a big deal. They removed any personal finance/budgeting classes from our school system, and never really gave us an allowance or anything while we grew up. They also, claiming it was for our own good, outlawed minors from virtually every type of work they did when they were growing-up.

For my generation, our budgeting consisted of, hey dad I need $100 for jeans, and you gave it to us. We never had a checkbook just plastic, which again allows you to run up debt at an alarming pace under the guise of buy now, pay later. You told us college was an investment in our future, so we went to college and ran up six figure student loan debt. We needed a car and instead of getting an economical used vehicle, we got a sporty type car fresh off the lot, and a loan to boot. Credit card, auto loans, and student loans created a toxic cocktail that is just starting to show its affects.

Just to be clear here, I’m not placing the blame of the debt on anyone, just the attitude of the millennials. We do not view a paycheck as wages for services rendered, we view it as money to spend. We don’t view credit cards as for emergencies only, we view it as a means of satisfying ourselves with short term happiness. We do not see this as money being spent, it’s just the swipe of a card, then the bill comes. But that’s ok, because we only have to pay a very small portion of the bill, then we keep spending. Our debts? Well almost every liberal politician, and probably some so called Republican ones, talk about wiping out our debts…therefore we vote for them. Debt to us is just a way of life, and we see a paycheck and annual mandated cost of living raises as a way by which to pay for it.

In closing, I will add this, I am a 33-year-old millennial who has no student loan debt, never had any, and I have no credit card debt. I own a house so there is debt there; however, I see it as at least having equity as opposed to paying a landlord in exchange for nothing. I am very lucky but none of my friends choose to live their lives like me; instead, they have mountains of student loan debt, credit card debts, and expensive car payments to boot. They make minimum payments, and all have nicer stuff than me. Their attitude is the government will bail them out at some point, or just wipe away the debt.

Lather, rinse, repeat

Owe money to the IRS just call a number…poof gone. Too much credit card debt…. personal bankruptcy…poof gone. Mortgage on a house you don’t like anymore…. walk away. Best of all regarding the last 2, (credit cards and mortgages), in several years you can do it all over again. However, my generation, like many others, is in for a real wakeup call soon because those rules do not apply to our nation’s debt. Your pension is not likely to be guaranteed–at least not at the levels they predict. Your government job may be cut, and Social Security for those of us in the private sector, is likely a figment of our imagination or soon will be.

Feel more secure yet?

Chief