I keep telling people that the debt obligations of our country including all the big ones like Social Security, Medicare, Federal Deficit, State, County & Local pensions, etc. are more than all the wealth on the planet but even I was surprised when I saw the latest calculation. You see, some enterprising folks on Wall Street ran the numbers and the story was published yesterday. Instead of being the lead story for the whole week, it was on Drudge for a few hours and then was bumped to the recycle bin.

If you thought politicians spend like drunken sailors, I can assure you that the boys in Crackerjack Uniforms only spend their own money, not that of your great grandchildren, yet to be born.

Real US debt levels could be 2,000% of economy, a Wall Street report suggests

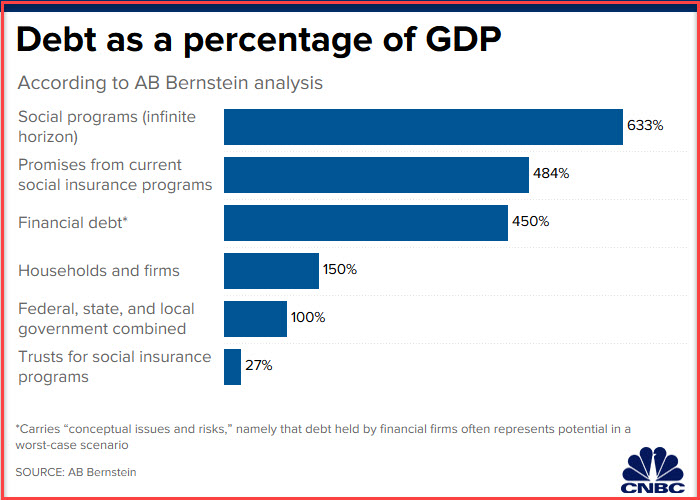

Total potential debt for the U.S. by one all-encompassing measure is running close to 2,000% of GDP, according to an analysis that suggests danger but also cautions against reading too much into the level.

AB Bernstein came up with the calculation — 1,832%, to be exact — by including not only traditional levels of public debt like bonds but also financial debt and all its complexities as well as future obligations for so-called entitlement programs like Social Security, Medicare and public pensions.

Putting all that together paints a daunting picture but one that requires nuance to understand. Paramount is realizing that not all of the debt obligations are set in stone, and it’s important to know where the leeway is, particularly in the government programs that can be changed either by legislation or accounting.

The article then goes on to say that we shouldn’t worry because we can afford the payment on the credit card.

The key is not always gross dollar amount but rather ability to pay.

I hope Dave Ramsey blows a gasket when he reads this. I can picture him saying, “The borrower is the slave of the lender.”

“Globally, we have become over-reliant on borrowing as a solution for everything. Political excuses abound for why it doesn’t matter, which just clearly isn’t the case,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget, a bipartisan committee of legislators, business leaders and economists that counts former Federal Reserve Chairs Paul Volcker and Janet Yellen among its members.

“We are quickly approaching a situation where we have dug ourselves a debt hole which isdoinggoing to have profoundly negative effects on the economy for probably decades going forward,” MacGuineas added.

I corrected typo in the above quote–editor

The article concludes with this wishful thinking:

“First, you start having politicians level with voters instead of promising freebies. Second, you recognize that the time to do that is when your economy is strong,” she said. “When people were arguing for more borrowing they should have been doing the reverse. We’re still not in recession. It’s time to put in long-term strategies.”

Folks, we have hundreds of trillions of dollars in debt obligations and yet we go merrily along thinking as long as the sun rises that everything will be OK. Remember my opening, we owe more money than all the wealth created on the planet. Someday this merry-go-round of debt will stop and then who will pay the Reaper? The emperor has no clothes and as long as we all agree then everything is OK, right?