By: Jake the Snake–an occasional contributor

Back in August 2018, the Knights of Columbus (a Catholic Church volunteer group) was served a lawsuit by a vendor alleging insurance fraud and manipulation, essentially running a Ponzi scheme.

U.S. District Court in Denver against the Knights of Columbus, claiming the Catholic-charity behemoth is using “phantom” numbers to fraudulently inflate its 1.4 million insurance pool of mostly aging members.

Denver lawsuit calls Knights of Columbus life insurance pool a racketeering scheme

The lawsuit, filed Tuesday by Greenwood Village attorney Jeffrey Vail on behalf of UKnight Interactive and manager Leonard Labriola, accuses the charity of artificially claiming that it has 1.9 million insureds worldwide by counting members who have dropped out. It also accuses the charity of stealing the company’s trade secrets.

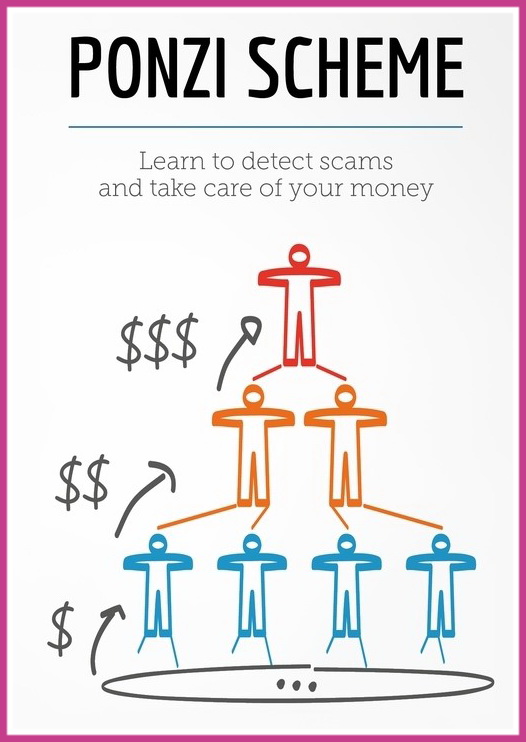

Another Catholic organization facing serious lawsuits stemming from misleading its members…heard that before? Sadly, as a member of said group, the lawsuit is wholly WITH merit, and not a baseless claim, as some may have you believe. See I work in the business and I can say there is manipulation and cooking the books taking place and has been for some time. I am here to tell you the insurance arm of this organization is a Ponzi scheme and will fail by 2033 if things don’t change rapidly. I will lay out my thesis and reasoning below.

First basic insurance 101: The company charges you a premium, and if nothing happens the insurance company gets to keep it, if something happens, they must pay out for a covered loss. One reason this line of work is very profitable is you pay them in today’s dollars, they pay out as long as 30 days after the incident, pocketing the difference. The monies collected can be invested, but a reserve enough to cover a certain threshold of claims must be kept liquid in order to meet obligations should they arise!

In the case of the Knights of Columbus (KOC) they only sell life insurance, annuities, retirement, and long-term care policies to members and their spouses. As a result, they have a very small pool from which to choose since members must not only be Catholics but a member of the organization! In the case of all these products, claims are not anticipated for years after buying the product; in many cases, life insurance never will pay out! However, the organization is aging and has not been able to attract younger members to backfill the monies now being paid out to dying members. Worse yet, every major player in California has ceased selling long term care as it is very underpriced and most companies with policies remaining are doubling prices annually just to tread water! Even worse, the Knight’s products are not priced adequately, many far below the premium of far more reputable companies such as the carrier I represent! Problem is, in recent years, the amount of money paid out, has far exceeded monies paid in, resulting in an operating loss.

“Indeed, the KC Supreme insurance program is only one step removed from a classic Ponzi scheme,” the lawsuit says. “This case involves an elaborate scheme of racketeering, fraud, deception, theft, and broken promises by the Knights of Columbus Supreme Council (KC Supreme) and two of their senior executives, Thomas Smith and Matthew St. John.”

The problem lies in a couple of areas, like many groups and organizations not involving drinking or trips to a gentlemen’s clubs, the membership skews older. KOC is no different. Over 30% are over the age of 70. Most of the Knights in this age group own multiple policies totaling several hundred thousand or possibly a million dollars. But that’s ok because what about the other 70% right? Well here’s the issue, they are inactive. They only joined because their parent/grandparent made them and has been paying their dues. (Think CRA but not as far down the drain.). The reality is that this group has not bought the insurance, thus saddling the KOC with an aging membership controlling most of the insurance liability to be paid upon death!

Most phantom members are younger men who quit because of the demands of raising children and families, the lawsuit says. Aging and retiring members tend to remain active, it says.

For example, KC Supreme advertised on its website that it had 45,000 new members in 2010, while counting phantom members and omitting the fact that with the numbers of members who died or withdrew, net membership numbers actually shrank, the lawsuit says.

This creates a reserve issue and here is where the racketeering comes into play, and this part of the fraud leads all the way to New Haven, Connecticut where the HQ is located.

A directive came out, saying we are not to drop a member for any reason if he has attained the highest degree of rank…the only way to drop a member is if he has not paid dues for over 5 years! Think about that; 5 years plus of non-payment! (again, very reminiscent of CRA.)

The charity props its membership rolls by forcing 15,392 local Knights of Columbus councils to continue paying nominal dues for former phantom members after they drop out, the lawsuit says. The charity requires councils to recruit a new member before allowing them to drop an old one, the lawsuit says.

Based on such rules, one local council in New Jersey reports that it has 316 members when it actually has 54 members, the lawsuit says. When a Dallas council asked to remove more than 80 “long-delinquent” members from its rolls, KC Supreme only allowed eight to be removed, the lawsuit says.

I say the only way, because the other ways to drop someone are automatic…felony…no longer a Catholic…those things. The root issue is the younger members aren’t buying policies and have no intention to do so in the future, and since many members aren’t paying dues for themselves, they are being kept around to artificially inflate the membership rolls. This is where the racketeering scheme comes into play, as the KOC can lie to credit rating agencies about how solvent they are. KOC Insurance company can hide behind “…well we have 1.9 million members we can sell our products too…so we can be solvent if given an opportunity.”

While local councils do volunteer and charitable work, KC Supreme, generates billions of dollars tax-free every year selling life insurance, the lawsuit says. The Knights of Columbus’ KC Supreme website falsely advertises that its membership of “brother knights” grew for the 44th consecutive year and will soon top 2 million men, the lawsuit says.

“In fact, the true membership of the Knights of Columbus without these ‘phantom’ members is only about 1.4 million — their published number represents an approximate 36% overstatement!” the lawsuit says.

The insurance is pushed very hard by the organization. It’s mentioned at all 4 degrees (steps) you go through to full knighthood. You are required to meet with the agent after joining the knighthood, and insurance is pushed at every meeting. The agents are similar to your neighborhood AMWAY sales guy, essentially programmed to take a “No” as a “Yes”, and to keep pushing for the sale, it’s a turn off. These insurance reps are paid a slave wage and become commission only after about a year, and only get 4 councils to sell to, many having aging populations who won’t be eligible for the products. Turnover is high, and usually you buy a handful of policies on yourself to advance the scheme in the sense of putting food on your own plate. Isn’t this taking advantage of someone which runs contrary to the church’s values? Think that is odd, try the “retirement” of Chief Investment Officer Tom Smith, who stepped down just after the lawsuit was served…. let me guess impeccable and unrelated timing, right? Probably said he needed to spend more time with his family. I think Smith knows this Ponzi is about to hit the fan. Why else would he resign from a job paying him $900K a year?

The fraternal order has $105 billion of insurance in force written against only $22 billion in assets, the lawsuit says. It says the Knights of Columbus organization “may very well be on the verge of financial collapse.”

I can say firsthand that the issues here are very real and true, heads are going to roll, and Pharisees and tax collectors described in the Bible will be shown in real modern form. I can say our council has 17 non-payers, and likely has at least that amount in next of kin whose dues are paid for by poppa.

A District Deputy (think regional manager) in Illinois has a council, that lists 300 members, but none have paid dues in years, and the council has not had a meeting in years. This narrative plays out everywhere leading me to believe the 1.9 million is closer to 1.1, making the “insurance pool” far less than advertised. A very heavy emphasis is put on recruiting, almost unhealthy emphasis, we just want a warm body capable of fogging a mirror, because they can buy a policy, thus buying time for the order.

My advice: Stay away from this group and if you have an insurance policy make sure the KOC belongs to the National Association of Insurance Commissioners, which in layman’s terms means if something were to happen and the insurance arm goes bankrupt, other companies step in to pay the claims/absorb the policies.

This is actually a very big deal, as many members have been misled about the insurance program and its long-term viability. The Chief Insurance Officer retiring, is likely more of a sign of a rat scurrying off the ship. Tom Smith is a coward of a human, yet no one is able to call him out. This story does not end well, and hopefully no one has any retirement monies invested in this scheme. Sit back and watch the dominoes fall boys and girls….and the Catholic Church wonders why it’s dying off.

Jake the Snake

Knight of Columbus