An old pastor once told me that the word “mortgage” is from two Latin words; “mort” meaning death like in mortuary and “gage” meaning grip, thus a mortgage was a “death grip”. This is what I thought of when I say this headline today:

1 in 5 millennials with debt expect to die without ever paying it off

The average millennial (aged 18 to 34) had about $32,000 in personal debt, excluding home mortgages, last year, according to Northwestern Mutual’s 2018 Planning & Progress Study. That debt can feel both crushing — and endless.

Just over 60 percent of millennials (classified here as those aged 18-37) with debt don’t know when, or if, they’ll ever be able to pay off what they owe, according to a new CreditCards.com report. That includes roughly 42 percent of millennials who don’t know when they’ll be able to wipe out their debt, and almost 20 percent of those who expect to die in debt.

Expecting to die with debt is not a formula or mindset for success. No wonder so many say they prefer socialism. This blog is about hope for the hopeless.

The above article, without attribution, then proceeds to list several of Dave Ramsey’s “baby steps” for getting out of debt. Ramsey has 7 steps to getting out of debt.

1 Save $1,000 to start an emergency Fund

2 Payoff all debt (except mortgage) using debt snowball

3 save 3-6 months of expenses

4 invest 15% in retirement

5 save for child’s college fund

6 pay off your home

7 Build wealth and give

I can attest that following Ramsey’s advice will put you on the path to financial freedom. The cornerstone of his plan is the Emergency Fund. By putting this money away, you have a pool of cash to use for car repairs, new tires, fixing the dishwasher, unplugging the drain, or whatever else life throws at you without reaching for the “magic plastic”.

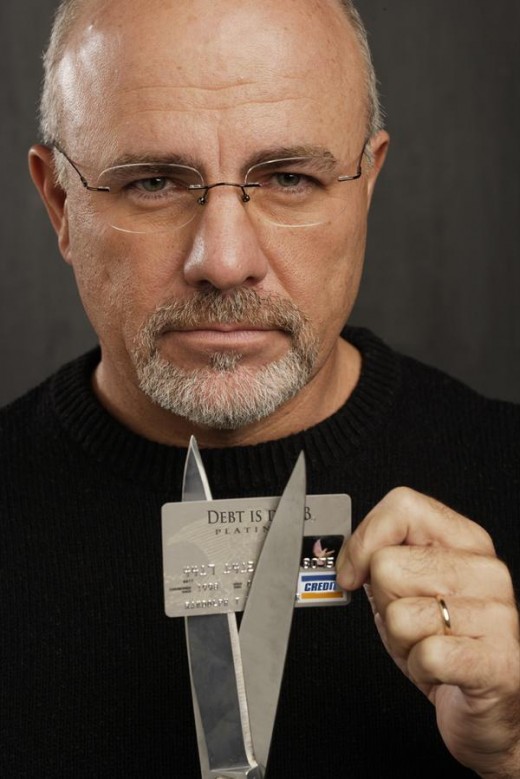

As you are saving this Emergency Fund, Ramsey asks people to cut-up their credit cards and use their Emergency Fund instead. Then replenish the money so you keep the fund available.

If you are married, it is vital that both of you agree on this course of action. Deciding to get out of debt must be a joint decision. You must be working together and not be unequally yoked to this idea. Nothing is more divisive in a marriage than fighting about money. To get both of you on the same page with getting debt free, Ramsey has classes that he offers called Financial Peace University. The cost of materials is about $100 but worth it.

My wife and I attended the Financial Peace classes at a local church about five years ago. I didn’t really know what to expect but found the classes helpful. The classes are held over several weeks. Part of the class is viewing Ramsey and some others, often his daughter, via a DVD presentation. The class facilitators also do various exercises with those attending, many of these are as groups. When we attended, there were eight or nine families. Any worksheets involving money are anonymous although those leading the group many have an idea who wrote which numbers.

The exercise that really got my attention was the one at the beginning where everybody listed their debts and then turned the number into the facilitators. This is part of a before v after comparison designed to show progress towards the baby steps of establishing an Emergency Fund and starting to pay off debt via a “snowball”. It was shocking when the total debt in the room was announced—remember this figure did not count anything owed on a home. Over half of the debt in the room belonged to me and my wife! It was a sobering moment.

Since that night we have paid-off over $100,000 of that original debt and the remaining balance will be gone before the end of 2019. Truthfully, we don’t stick with the snowball as religiously as we could. We still allow for vacations and a few wants. We are honest enough to distinguish between “wants” and “needs”; however, we always pay cash.

A word of caution, when you start cancelling credit cards, the offers begin pouring into your mailbox. Ramsey is a big advocate of going “cold turkey” on the plastic. Cut it up, throw it away, and never look back. Your dealers, Wells Fargo, Citibank, Discover, Golden 1, Chase, Amazon, Costco, etc., will really miss their 24 percent payment each month and offer you even more debt to come back.

I think of it as free drugs from the dealer just to get you hooked again. Two percent cash back is still 22 percent to the dealer so exactly how is that a bargain? Buy the heroine and get free needles? Oops, not blogging about San Francisco today.

Anyway, if you are up to your eyeballs in debt, there really is hope and a support network should you need it. Yes, your lifestyle may change as you learn to live within your means but freedom has always had a price. The only thing better than being debt free is teaching your children to learn from your mistakes and showing them a better way.

Since starting down this path, we are optimistic about our future. How many of you still paying for DirecTV so you can watch Fox News and CNN can say the same?