We all know that the Trump tax-cut made changes to the Standard Deduction and Payroll Tax Withholding Tables but wait ‘til you sit down and try doing your taxes this year. When you do, forget everything that you thought you knew about filling out the tax forms. The forms that you knew and loved don’t exist!

| Form 1040 EZ | Deleted |

| Form 1040A | Deleted |

| Form 1040 | Nuked |

Instead, now there is one form to rule them all and one form to find them, there is only the 1040…and a bucket load of worksheets to bind them.

For Tax Year 2018, you will no longer use Form 1040A or Form 1040EZ, but instead will use the redesigned Form 1040. Many people will only need to file Form 1040 and no schedules.

About Form 1040, U.S. Individual Income Tax Return

While its not the mythical postcard form that we were promised decades ago, the form has taxpayer information on the first page and all the math on the second. For the most part, the actual calculations are on the six new worksheets. Page 2 of the 1040 is just filling in totals or leaving nonapplicable boxes blank. The tax tables don’t even go above earnings of $100K. If you and the spouse, make over $100K then you take the earning amount and multiple it by a decimal number and that’s your tax! Easy Peasy.

While my wife and I will probably use the Standard Deduction and thus not need to itemize for a Federal filing, the question is what in the heck will California do? We know they don’t like Trump or how the tax cut was crafted but will I miss deductions on the California return if I do the quick and dirty math on the federal form and send it in? Usually states try to mirror what the national government does but, in this instance, I have no confidence that this is the case.

Presently I have no clue; partially because TurboTax doesn’t work yet. I bought the software on December 31st and got hard stops in the program when I put in my estimates for 2018 taxes. Schedule A –the form where you itemize everything–was broken. Intuit is promising to have the software up and going in mid-January (about now) but I suspect they will be pushing out updates for many more weeks.

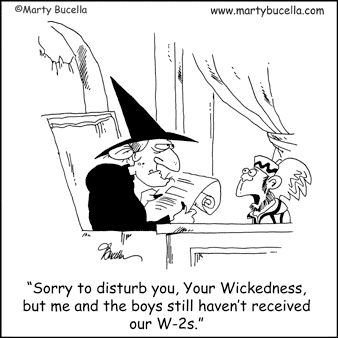

W-2s are required to be mailed by the end of January. The government shutdown may affect your ability to get a refund but somehow, I think if you send Uncle Sam a check, he will be happy to cash it anyway.

Based on what I can discern thus far, it appears that our days of getting a big refund are at an end. By lowering the withholding amount from each paycheck and giving me more monthly take home pay, it looks like I may actually stand a chance of writing a check to the government for the first time. If you usually bank on a big refund, I’m warning you that it may not happen. Both my wife and I claim married with zero dependents, this is the largest amount withheld on the tax tables. If we’re sweating about not getting a refund, some on you are probably in big trouble. Don’t wait until the last minute, especially this year.

If you think you’re going to come up short, file you tax return anyway. The biggest penalties from the IRS are for not filing. I know you can arrange payment but do this before April 15th and I think it will go better for you.